Managing a hotel is a complex operation with multiple moving parts, from handling staff payroll to paying out vendors. So it’s no surprise that the accounting side of it is distinct and multifaceted, going far beyond the simple ledger entries of revenue and expenses.

It requires a thorough understanding of the intricate operations of the hospitality industry and how they affect the hotel’s finances.

When done right, a robust hotel accounting system becomes an essential tool for ensuring financial compliance and steering strategic decision-making. It also provides valuable performance evaluation data and uncovers potential growth opportunities.

So how do all these intricate nuances work together to create one of these essential pillars that holds up your entire operation? That’s what we’re here to cover.

Simply put, accounting for hotels deals with the unique financial management , record-keeping, and reporting needs of the hotel industry.

Since hotels tend to have a lot of moving parts, it entails a comprehensive range of all your financial operations and procedures to accurately manage and report a hotel’s revenues, expenses, assets, and liabilities.

The goal is to present a transparent, precise image of a hotel’s financial status to owners, managers, investors, and other stakeholders.

Typically, this is organized in a chart of accounts (COA)—a structured list is used to track its financial transactions and to prepare financial reports.

In hotel accounting, the COA is particularly important due to the diverse sources of revenue and the wide range of expenses that hotels typically have. Most COAs keep track of the following:

The COA can also vary significantly between hotels depending on how your hotel is set up. For example, a small, independent hotel might have a much simpler chart of accounts than a large hotel chain that has multiple properties, restaurants, entertainment venues, etc.

Even though accounting is fairly similar across many industries, there are several unique characteristics of hotel accounting that differentiate it from other types of business accounting. Here are some of these aspects:

Hotels are complex businesses with multiple income-generating departments such as rooms, food and beverage, spa, and others. Each department has its own unique set of costs and revenues, which need to be tracked separately.

This helps hotel management identify the profitability of each department and make informed decisions.

Night audits are a critical part of hotel accounting and operations, taking place at the end of each business day.

During a night audit, financial transactions of the day are:

The night audit ensures that all financial records are accurate and that hotel operations continue to run smoothly.

From room occupancy rates to food and beverage revenue, daily reports provide an in-depth look at a hotel’s financial health.

These reports play a critical role in the hotel’s financial management strategy, allowing managers to:

By analyzing daily reports, hotel managers can quickly respond to changes in demand, adjust pricing strategies, and optimize resource allocation for maximum profitability.

Hotels often see significant variations in demand based on seasons, holidays, and events. These variations affect hotel pricing strategies, and as a result, revenue and expenses can vary significantly throughout the year.

Understanding and managing seasonality and rate fluctuations are crucial for a hotel’s financial success.

Given the high volume of transactions that occur daily in a hotel, from guest payments to vendor payments, and payroll transactions, it’s vital to ensure that the hotel’s financial records match the information on the bank statements.

During a bank reconciliation , discrepancies between the hotel’s cash account records and the records of the hotel’s bank are identified and rectified. These discrepancies could be due to timing differences (e.g., checks issued but not yet cashed), errors, or potentially fraudulent activities.

Regular bank reconciliation helps to maintain the accuracy of a hotel’s financial records, aids in detecting any unusual transactions and provides an accurate picture of the hotel’s available cash for operations.

As you can imagine, hotel accounting becomes even more complex the more you add to your portfolio. While you might have been able to get away with managing your finances with generic software for the first hotel or two, the larger you grow, the more you will need hotel-specific accounting software .

Modern hotel accounting software has become an essential tool for managing the complex financial operations of a hotel as it helps you:

If you haven’t already done so, implementing hotel accounting software is a vital step toward achieving efficient financial management. Here are the basic steps for implementing hotel accounting software:

While there’s plenty of accounting software available on the market, the best ones for hotels are designed specifically with them in mind. Here are some of the top choices available:

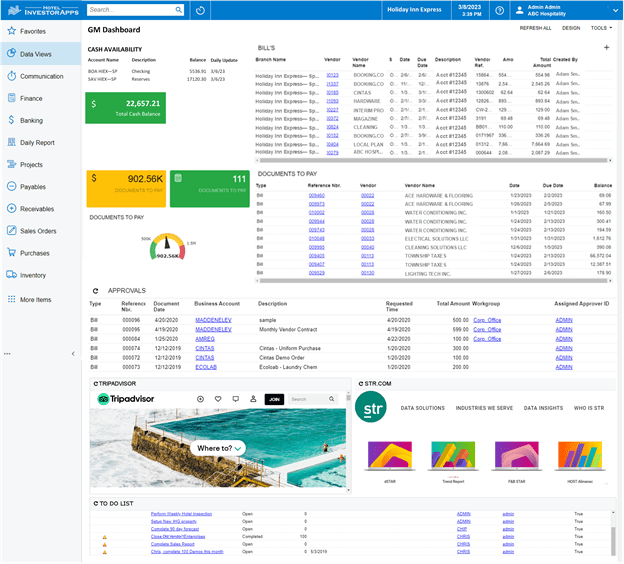

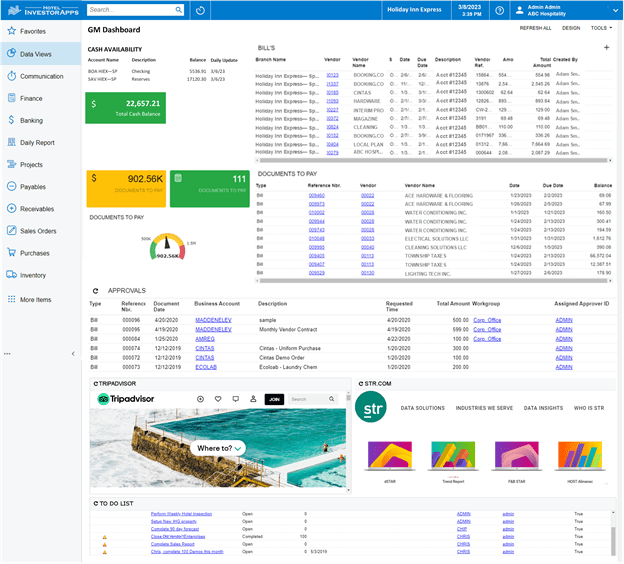

HIA is a comprehensive cloud-based ERP and financial management solution that transforms how hotel managers handle their back-office operations. It does away with outdated systems and manual spreadsheet updating with built-in automations and workflows.

Through automated reporting and user-friendly dashboards, HIA provides real-time data that enables managers to make informed decisions.

Its cloud-based nature also allows for seamless integration with existing systems, making it an ideal solution for hotels aiming to maximize efficiency and profits.

An established name in the hotel accounting sector, M3 offers a cloud-hosted solution that unifies various aspects of financial management into one platform.

From financial analytics to supply chain optimization, M3 provides comprehensive features that boost the financial performance of hotels, regardless of their size.

Despite its age, M3 maintains its relevance through its versatile and easy-to-navigate interface, making it a robust tool for efficient financial management.

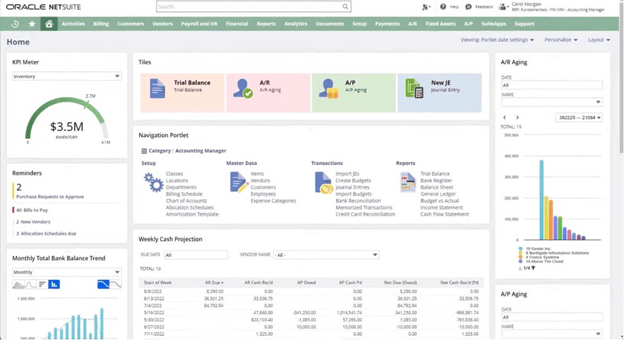

Oracle NetSuite is a general-purpose ERP solution that offers a suite of features useful to hotels. While it’s not specifically designed for the hospitality sector, its ability to streamline financial management and operational tasks can be valuable to many businesses.

With integrated financial management capabilities, real-time operational support, and a built-in CRM, NetSuite provides a lightweight yet powerful tool that simplifies many accounting tasks and saves valuable time.

It’s customizable dashboards, and powerful automation features make it a strong contender in the field of accounting software.

Managing a hotel’s finances is a demanding but vital task. The complexity of the hotel industry makes it imperative to employ robust accounting tools and techniques to stay afloat and thrive.

As your portfolio grows, so do your financial responsibilities and the need for precise and timely accounting. Equipped with the right tools and knowledge, you can streamline your accounting processes and put your hotel on a path to greater profitability.

If you have any questions about our ERP and accounting software, please contact a member of our team . We’d be happy to answer any questions you might have.